Irs Hsa Max 2025. The limit for families will be $8,300. The irs recently released inflation adjustments (rev.

The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

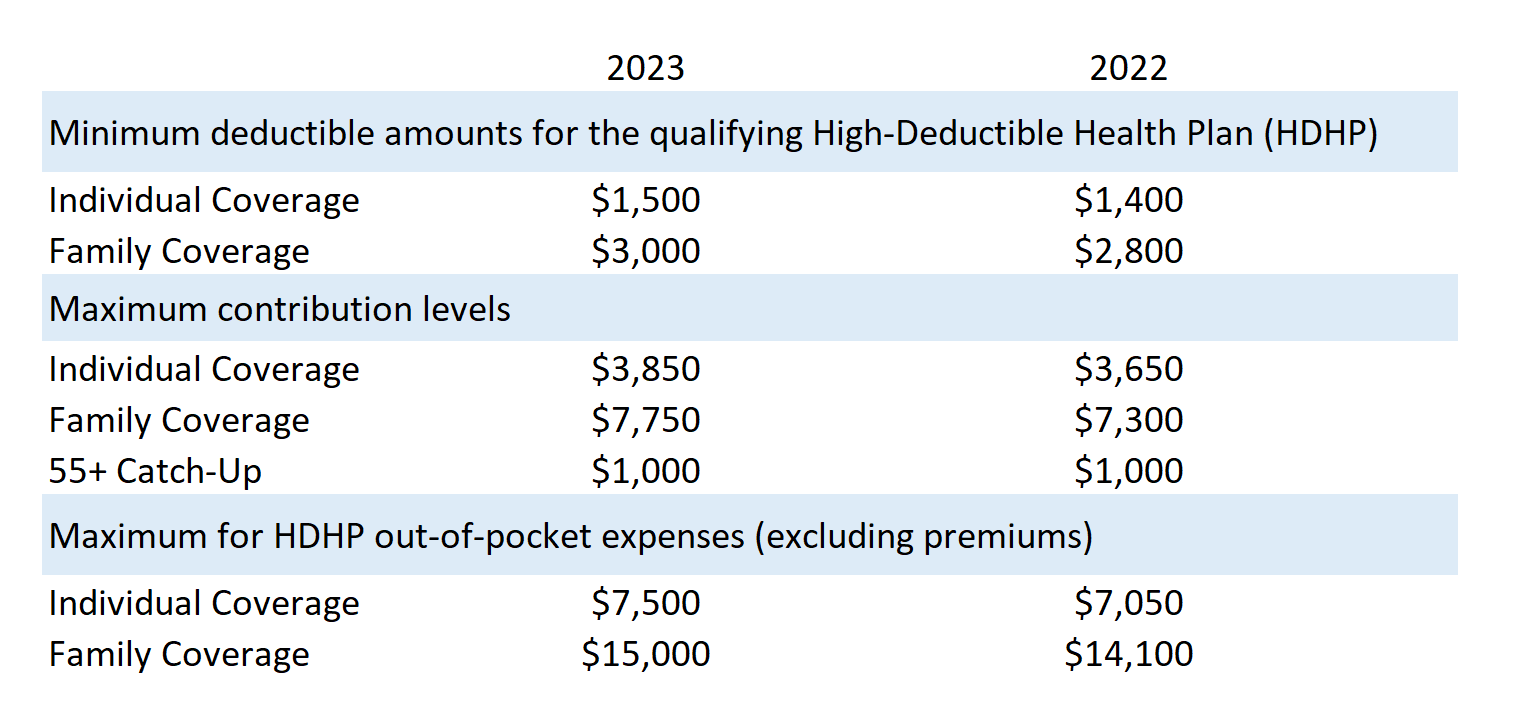

Significant HSA Contribution Limit Increase for 2025, The irs recently released inflation adjustments (rev. Health savings accounts, or hsas, have higher contribution limits in 2025 and 2025, allowing you to save more for your healthcare expenses if you’re using a high.

Hsa Limits 2025 Rycca Clemence, The hsa contribution limits increased from 2025 to 2025. 8, 2025 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may be.

2025 HSA & HDHP Limits, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. The hsa contribution limit for family coverage is $8,300.

IRS Issues 2025 HSA and EBHRA Limits Innovative Benefit Planning, Individuals can contribute up to $4,150 to their hsa accounts for 2025, and. In may, the irs announced a significant increase to the annual hsa contribution limit for 2025.

IRS Announces 2025 HSA Contribution Limits, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. Individuals can contribute up to $4,150 to their hsa accounts for 2025, and.

IRS Announces HSA Limits for 2025, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. Health savings accounts, or hsas, have higher contribution limits in 2025 and 2025, allowing you to save more for your healthcare expenses if you’re using a high.

IRS Announces HSA and High Deductible Health Plan Limits for 2025, The hsa contribution limit for family coverage is $8,300. Health savings accounts, or hsas, have higher contribution limits in 2025 and 2025, allowing you to save more for your healthcare expenses if you’re using a high.

IRS Announces 2025 HSA Limits Inova Payroll, Use this information as a reference, but please visit irs.gov for the latest. The irs recently released inflation adjustments (rev.

.png)

IRS Announces Updated HSA Limits for 2025 First Dollar, Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday. How do the hsa contribution limits for 2025 compare to the ones from 2025?

IRS releases HSA index figures for 2025 CIP Group, 8, 2025 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may be. How do the hsa contribution limits for 2025 compare to the ones from 2025?

For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.