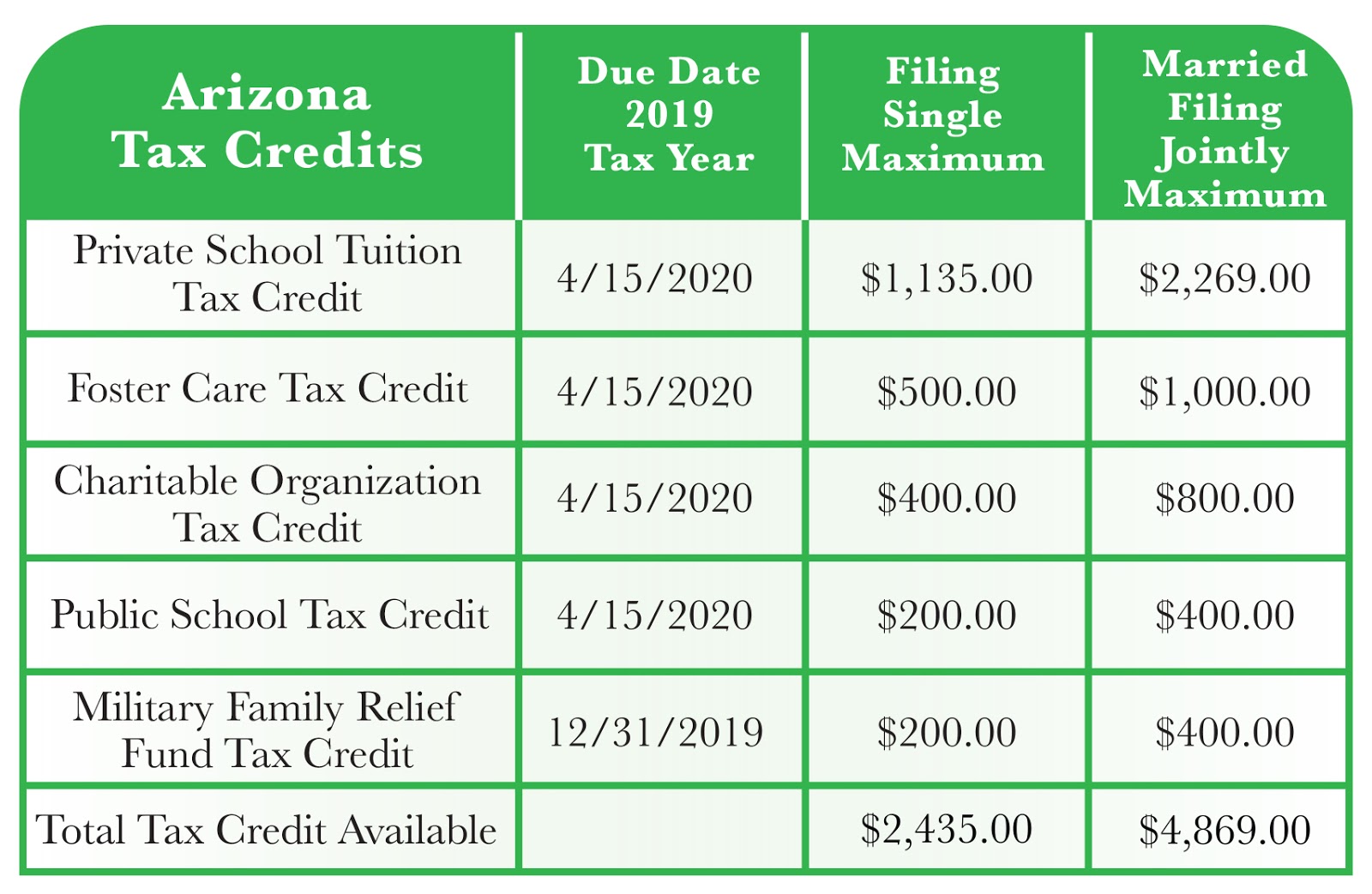

Arizona Tax Credits 2025 Charity. There are four major tax credits that you can use to offset certain charitable donations in arizona. • the arizona charitable tax credit allows you to donate to qualifying charitable organizations (qco’s) and qualifying foster care charitable organization (qfco’s).

And qco is just one of four credits available to benefit qualified. One for donations to qualifying charitable organizations (qco) and the second for donations to qualifying foster care charitable organizations (qfco).

Arizona Charitable Tax Credit Duet, A married couple filing jointly can get credit for up to $800 donated to a qualified charitable organization (qco).

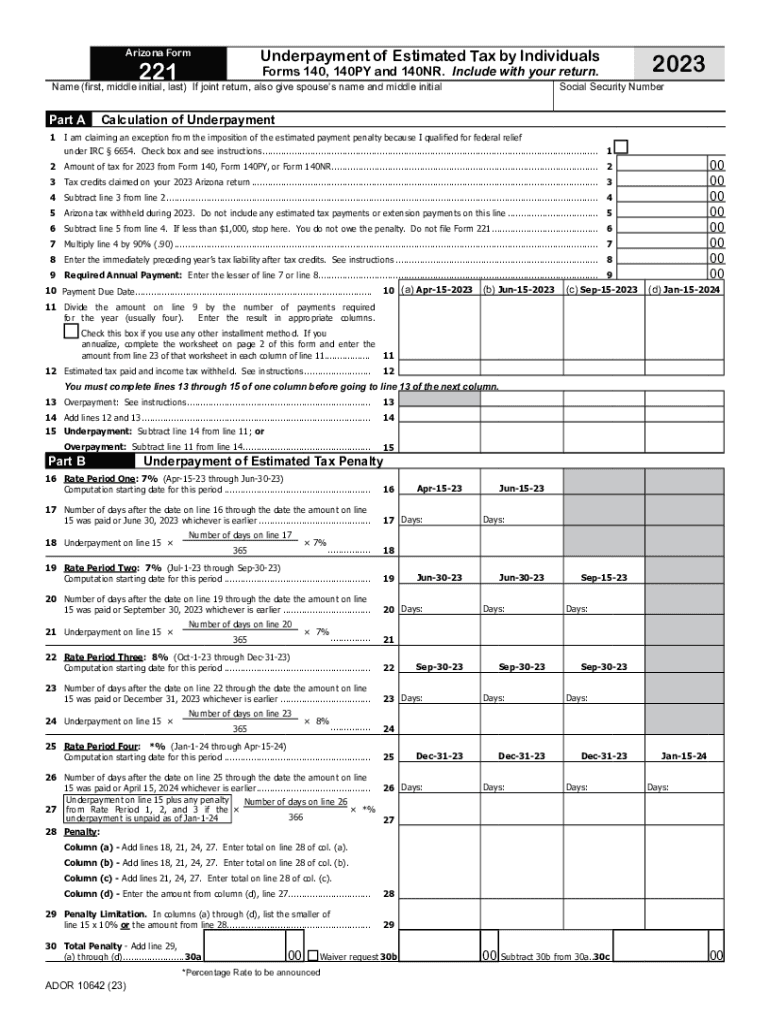

Arizona State Tax Credits 2025 Maxie Sibelle, You must complete and include form 301 with the appropriate individual credit form (s) (any form that starts with 3) with your return.

Arizona State Tax Credits 2025 Maxie Sibelle, Arizona tax law provides a tax credit for contributions made to qualifying charitable organizations (qco) providing assistance to underprivileged members of the community.

Arizona Charitable Donation Tax Credit 2025 2025, There are two tax credits available to individual income taxpayers for charitable donations:

Arizona Charitable Tax Credit AZ Form 321 Fill Out and Sign Printable, One for donations to qualifying charitable organizations (qco) and the second for donations to qualifying foster care charitable organizations (qfco).

Know Your Arizona Tax Credits for Charitable Contributions Thompson, The 2025 arizona charitable tax credit has increased from $421 to $470 for individuals and from $841 to $938 for couples filing jointly.

What is Arizona Charitable Tax Credit Donations? Children's Care Arizona, Arizona provides two separate tax credits for individuals who make contributions to charitable organizations:

4Tucson A Qualified Charitable Organization for Arizona Tax Credits, For 2025, the maximum amount of this.

arizona charitable tax credit fund Cammy Montague, Through the arizona charitable tax credit you can receive a credit on your arizona tax liability up to $470 individually or $938 for couples filing jointly.

Guide to Arizona Charitable Tax Credit AZ Tax Credits, Each arizona tax credit is tied to charitable giving, so you get to feel good about your contributions and save money on your taxes at the same time.